How Much is it Worth For inverted triangle chart pattern

How Much is it Worth For inverted triangle chart pattern

Blog Article

Mastering Triangle Chart Patterns for Better Trading Methods

Article:

Triangle chart patterns are fundamental tools in technical analysis, providing insights into market patterns and possible breakouts. Traders worldwide rely on these patterns to forecast market movements, particularly throughout combination phases. Among the key reasons triangle chart patterns are so widely utilized is their ability to show both extension and reversal of patterns. Understanding the complexities of these patterns can help traders make more informed choices and optimize their trading methods.

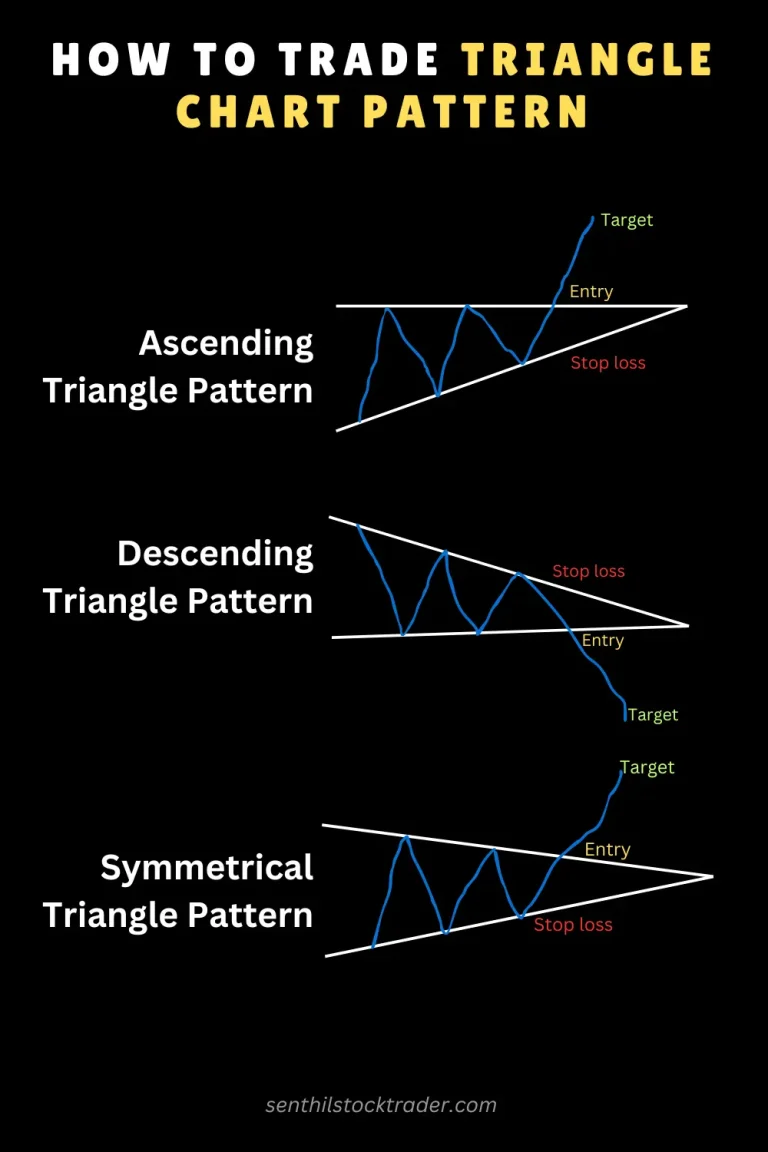

The triangle chart pattern is formed when the price of a stock or asset varies within assembling trendlines, forming a shape resembling a triangle. There are various types of triangle patterns, each with unique attributes, offering various insights into the potential future price motion. Among the most typical types of triangle chart patterns are the symmetrical triangle chart pattern, the ascending triangle chart pattern, the descending triangle chart pattern, and the expanding triangle chart pattern. Traders likewise pay close attention to the breakout that takes place once the price relocations beyond the triangle's boundaries.

Symmetrical Triangle Chart Pattern

The symmetrical triangle chart pattern is among the most regularly observed patterns in technical analysis. It happens when the price of an asset moves into a series of greater lows and lower highs, with both trendlines converging towards a point. The symmetrical triangle represents a duration of debt consolidation, where the market experiences indecision, and neither purchasers nor sellers have the upper hand. This duration of balance typically precedes a breakout, which can happen in either direction, making it important for traders to stay alert.

A symmetrical triangle chart pattern does not provide a clear indicator of the breakout direction, suggesting it can be either bullish or bearish. However, numerous traders utilize other technical indicators, such as volume and momentum oscillators, to identify the most likely direction of the breakout. A breakout in either direction signals the end of the combination stage and the start of a new trend. When the breakout occurs, traders frequently anticipate significant price movements, offering financially rewarding trading chances.

Ascending Triangle Chart Pattern

The ascending triangle chart pattern is a bullish formation, representing that purchasers are gaining control of the marketplace. This pattern takes place when the price creates a horizontal resistance level, while the lows move upward, creating an upward-sloping trendline. The key feature of an ascending triangle is that the resistance level stays continuous, however the increasing trendline recommends increasing purchasing pressure.

As the pattern develops, traders anticipate a breakout above the resistance level, signaling the continuation of a bullish trend. The ascending triangle chart pattern frequently appears in uptrends, strengthening the concept of market strength. Nevertheless, like all chart patterns, the breakout needs to be validated with volume, as a lack of volume throughout the breakout can show a false move. Traders likewise utilize this pattern to set target prices based upon the height of the triangle, including another measurement to its predictive power.

Descending Triangle Chart Pattern

In contrast to the ascending triangle, the descending triangle chart pattern is normally considered as a bearish signal. This development takes place when the price develops a horizontal assistance level, while the highs move downward, forming a downward-sloping trendline. The descending triangle pattern shows that offering pressure is increasing, while purchasers battle to preserve the support level.

The descending triangle is typically found during downtrends, showing that the bearish momentum is most likely to continue. Traders typically anticipate a breakdown below the support level, which can lead to significant price decreases. Similar to other triangle chart patterns, volume plays a vital role in verifying the breakout. A descending triangle breakout, coupled with high volume, can signal a strong extension of the sag, offering valuable insights for traders looking to short the marketplace.

Expanding Triangle Chart Pattern

The expanding triangle chart pattern, likewise referred to as a broadening formation, varies from other triangle patterns because the trendlines diverge instead of converging. This pattern takes place when the price experiences greater highs and lower lows, producing a shape that resembles an expanding triangle. Unlike the symmetrical, ascending, or descending triangle patterns, the expanding triangle pattern recommends increasing volatility in the market.

This pattern can be either bullish or bearish, depending upon the direction of the breakout. However, the expanding triangle pattern is typically viewed as a sign of unpredictability in the market, as both buyers and sellers battle for control. Traders who recognize an expanding triangle may want to await a verified breakout before making any significant trading choices, as the volatility associated with this pattern can cause unforeseeable price movements.

Inverted Triangle Chart Pattern

The inverted triangle chart pattern, likewise known as a reverse symmetrical triangle, is a variation of the symmetrical triangle. In this pattern, the price makes broader changes as time advances, forming trendlines that diverge. The inverted triangle pattern frequently shows increasing uncertainty in the market and can triangle chart pattern breakout signal both bullish or bearish turnarounds, depending on the breakout direction.

Comparable to the expanding triangle pattern, the inverted triangle suggests growing volatility. Traders must use caution when trading this pattern, as the large price swings can result in abrupt and remarkable market motions. Confirming the breakout direction is vital when interpreting this pattern, and traders typically rely on extra technical indications for additional verification.

Triangle Chart Pattern Breakout

The breakout is one of the most important aspects of any triangle chart pattern. A breakout happens when the price relocations decisively beyond the boundaries of the triangle, indicating completion of the consolidation stage. The direction of the breakout figures out whether the pattern is bullish or bearish. For instance, a breakout above the resistance level in an ascending triangle is a bullish signal, while a breakdown listed below the assistance level in a descending triangle is bearish.

Volume is a critical factor in validating a breakout. High trading volume throughout the breakout indicates strong market involvement, increasing the probability that the breakout will lead to a sustained price motion. Alternatively, a breakout with low volume may be a false signal, resulting in a possible turnaround. Traders should be prepared to act quickly when a breakout is validated, as the price motion following the breakout can be rapid and considerable.

Bearish Symmetrical Triangle Chart Pattern

Although symmetrical triangle patterns are neutral by nature, they can likewise offer bearish signals when the breakout strikes the disadvantage. The bearish symmetrical triangle chart pattern occurs when the price consolidates within converging trendlines, but the subsequent breakout moves listed below the lower trendline. This signals that the sellers have actually gained control, and the price is most likely to continue its down trajectory.

Traders can profit from this bearish breakout by short-selling or utilizing other strategies to profit from falling prices. As with any triangle pattern, confirming the breakout with volume is necessary to avoid false signals. The bearish symmetrical triangle chart pattern is particularly helpful for traders seeking to determine extension patterns in drops.

Conclusion

Triangle chart patterns play a crucial function in technical analysis, offering traders with important insights into market trends, combination phases, and potential breakouts. Whether bullish or bearish, these patterns offer a dependable way to predict future price movements, making them indispensable for both novice and experienced traders. Comprehending the various kinds of triangle patterns-- symmetrical, ascending, descending, expanding, and inverted-- allows traders to develop more effective trading methods and make notified choices.

The key to successfully utilizing triangle chart patterns depends on acknowledging the breakout direction and verifying it with volume. By mastering these patterns, traders can improve their ability to prepare for market motions and take advantage of lucrative opportunities in both fluctuating markets. Report this page